Generate 3x Salary or Revenue from Consulting by Upskilling Yourself

3 Hour LIVE Workshop

Small Call to Action Headline

Learn GST Practically and

Become an In-Demand Professional!

Workshop Detail

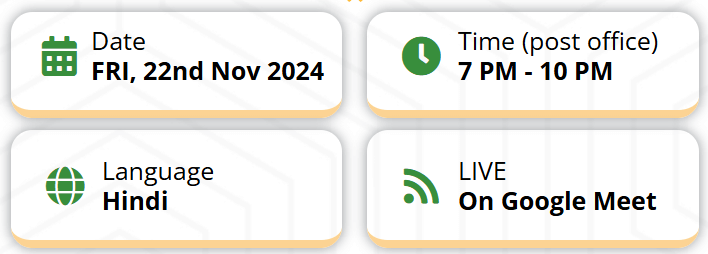

Date

FRI, 22nd Nov 2024

Time (post office)

7 PM - 10 PM

Language

Hindi

LIVE

On Google Meet

ENROLLMENT CLOSES ON NOVEMBER 21, 2024

Register in Next 15:00 Mins

Generate 3x Salary or Revenue from Consulting by Upskilling Yourself

3 Hour LIVE Workshop

Small Call to Action Headline

Learn GST Practically and

Become an In-Demand Professional!

Workshop Detail

ENROLLMENT CLOSES ON

NOVEMBER 21, 2024

Register in next 15:00 mins

What You'll Learn During This 3 Hour Workshop?

CONCEPT AND BASICS OF GST

OVERVIEW OF THE GST PORTAL

GST REGISTRATION - PRACTICAL

CONCEPT OF ITC, GSTR-2A & GSTR-2B

GSTR-1 AND GSTR-3B FILING

COMMON MISTAKES TO AVOID

ENROLLMENT CLOSES ON 21st NOVEMBER 09, 2024

Why should you join this workshop?

Imagine being able to confidently navigate the GST portal, file returns accurately, and claim your Input Tax Credit without a hitch. Picture yourself streamlining GST for your business or becoming the go-to accountant for all GST-related matters.

This workshop is your chance to break free from the confusion, whether you're aiming to boost your career or ensure your business thrives. For just INR. 199/- you’ll gain practical knowledge that will stay with you for life, transforming the way you approach taxation.

Make a lasting impact on your career and your financial future—this is the investment of time you won’t regret!

What You'll Learn During This 3 Hour Workshop?

✅ CONCEPT AND BASICS OF GST

✅ OVERVIEW OF THE GST PORTAL

✅ GST REGISTRATION PRACTICAL

✅ CONCEPT OF ITC, GSTR 2A & 2B

✅ GSTR-1 & 3B FILING

✅ COMMON MISTAKES TO AVOID

ENROLLMENT CLOSES ON NOVEMBER 21, 2024

Why should you join this workshop?

Imagine being able to confidently navigate the GST portal, file returns accurately, and claim your Input Tax Credit without a hitch. Picture yourself streamlining GST for your business or becoming the go-to accountant for all GST-related matters.

This workshop is your chance to break free from the confusion, whether you're aiming to boost your career or ensure your business thrives. For just INR. 199/- you’ll gain practical knowledge that will stay with you for life, transforming the way you approach taxation.

Make a lasting impact on your career and your financial future—this is the investment of time you won’t regret!

Detailed Breakdown Of What Will Be Covered

Concept & basics of GST

✅ GST - A Form of Indirect Tax

✅ Hierarchy of Supply in GST

✅ Practical Example Explanation

Overview of GST Portal

✅ Complete Tour of GST Portal

✅ Different Tabs in GST Portal

✅ Accessing all Updates in GST

GST Registration - Practical

✅ Who Should Register in GST ?

✅ Documents Required

✅ Practical Registration Session

ITC, GSTR - 2A & 2B

✅ Concept & Relevance of ITC

✅ Conditions for Claiming ITC

✅ Difference in GSTR-2A and 2B

GSTR-1 & 3B Filings

✅ GSTR -1 Practical Session

✅ Correct Way of Claiming ITC

✅ GSTR - 3B Practical Session

Common Mistakes

✅ Common Mistakes During Filing

✅ How To Avoid The Same

✅ Important Points To Keep In Mind

ENROLLMENT CLOSES ON November 21, 2024

Who Is This Workshop For?

Commerce Graduates

CA Inter & Final Students

Working Accountants

Small Business Owners

Anyone Interested in Learning GST Practically

Register before midnight of 9th November, 24

& Unlock All Bonuses Worth INR 7999/-

Register before midnight of 21st November, 24

& Unlock All Bonuses Worth INR 7999/-

EXCLUSIVE BONUSES #1

Certificate of Completion (Digitally Signed)

Upon successfully attending the entire workshop, you will receive a digitally signed Certificate of Completion within 3 days after workshop.

This certificate not only validates your participation but also serves as proof of your learning.

It can enhance your resume, demonstrate your commitment to professional development, and serve as a valuable record of your GST knowledge, contributing to your career growth.

EXCLUSIVE BONUSES #2

Navigating GST - A Practical Handbook for Businesses

Dive into Navigating GST: A Practical Handbook for Businesses, your essential guide to mastering GST.

This e-book covers key topics, including Step-by-step Proccess for GST registration, types of GST & applicability, tax invoices vs. bill of suppy, returns deadlines, late fees and penalties, GSTR-2A vs. GSTR-2B (ITC Statement) & much more.

Perfect for entrepreneurs and accountants, it provides practical insights to help you navigate the complexities of GST with confidence.

EXCLUSIVE BONUSES #3

Streamline Your GST Processes with Automated Templates!

Say goodbye to manual errors with our comprehensive set of automated Excel templates designed for all your GST documentation needs.

This bonus includes templates for GST Invoices, Credit Notes, Delivery Challans, Payment Vouchers, Purchase Registers, Receipt Vouchers, Refund Vouchers, and Sales Registers.

Effortlessly manage your transactions and ensure compliance, saving you time and reducing the hassle of GST filing.

EXCLUSIVE BONUSES #1

Certificate of Completion

(Digitally Signed)

Upon successfully attending the entire workshop, you will receive a digitally signed Certificate of Completion within 3 days after workshop.

This certificate not only validates your participation but also serves as proof of your learning.

It can enhance your resume, demonstrate your commitment to professional development, and serve as a valuable record of your GST knowledge, contributing to your career growth.

EXCLUSIVE BONUSES #2

Navigating GST - A Practical Handbook for Businesses

Dive into Navigating GST: A Practical Handbook for Businesses, your essential guide to mastering GST.

This e-book covers key topics, including Step-by-step Proccess for GST registration, types of GST & applicability, tax invoices vs. bill of suppy, returns deadlines, late fees and penalties, GSTR-2A vs. GSTR-2B (ITC Statement) & much more.

Perfect for entrepreneurs and accountants, it provides practical insights to help you navigate the complexities of GST with confidence.

EXCLUSIVE BONUSES #3

Streamline Your GST Processes with Automated Templates!

Say goodbye to manual errors with our comprehensive set of automated Excel templates designed for all your GST documentation needs.

This bonus includes templates for GST Invoices, Credit Notes, Delivery Challans, Payment Vouchers, Purchase Registers, Receipt Vouchers, Refund Vouchers, and Sales Registers.

Effortlessly manage your transactions and ensure compliance, saving you time and reducing the hassle of GST filing.

About Your Coach

Hey, there!

Hi, I’m Nupur Jain, a Chartered Accountant with 8+ years of expertise inIndirect Taxation, specializing in GST. Over the years, I’ve helped students learn and businesses streamline their GST compliance and navigate complex tax laws with ease.

In this 3-Hour Live GST Practical Workshop, I’ll simplify the essential concepts, guiding you through hands-on GST filing, ITC claims, and compliance strategies. Whether you’re a commerce graduate, accountant, or small business owner, this workshop will equip you with practical tools to master GST.

Let’s break down the complexity together and make GST work for you!

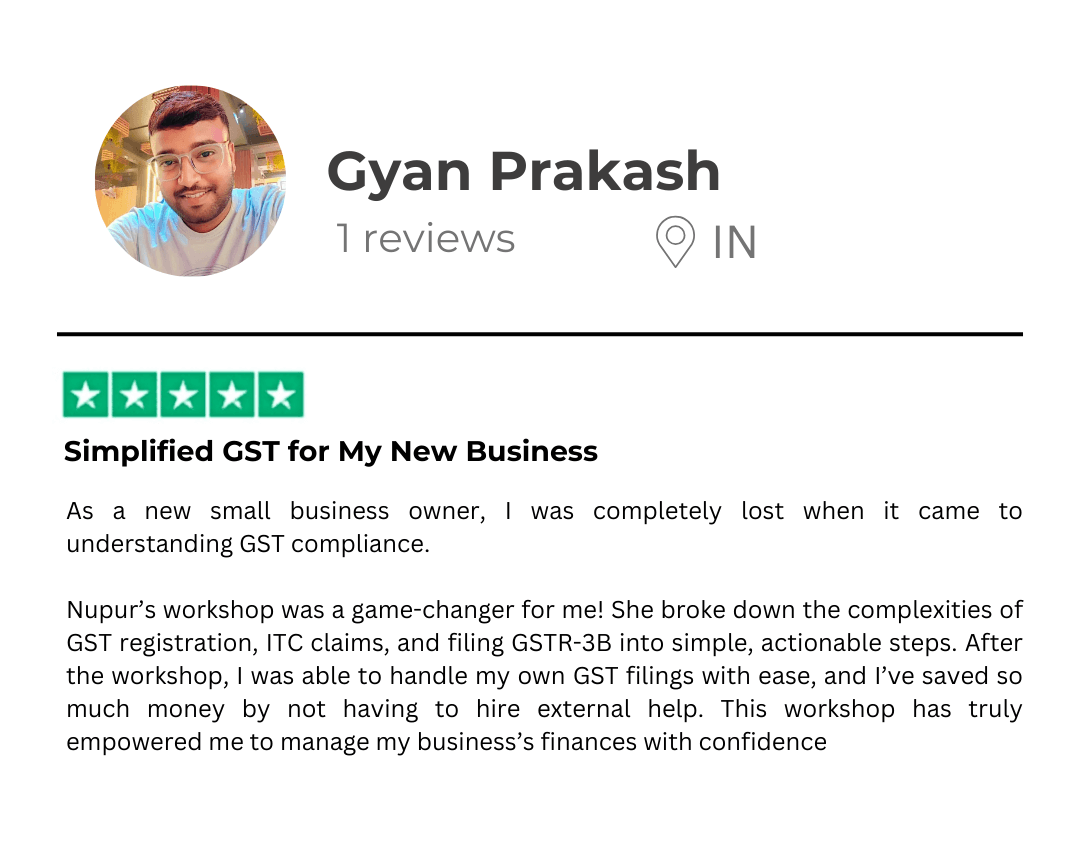

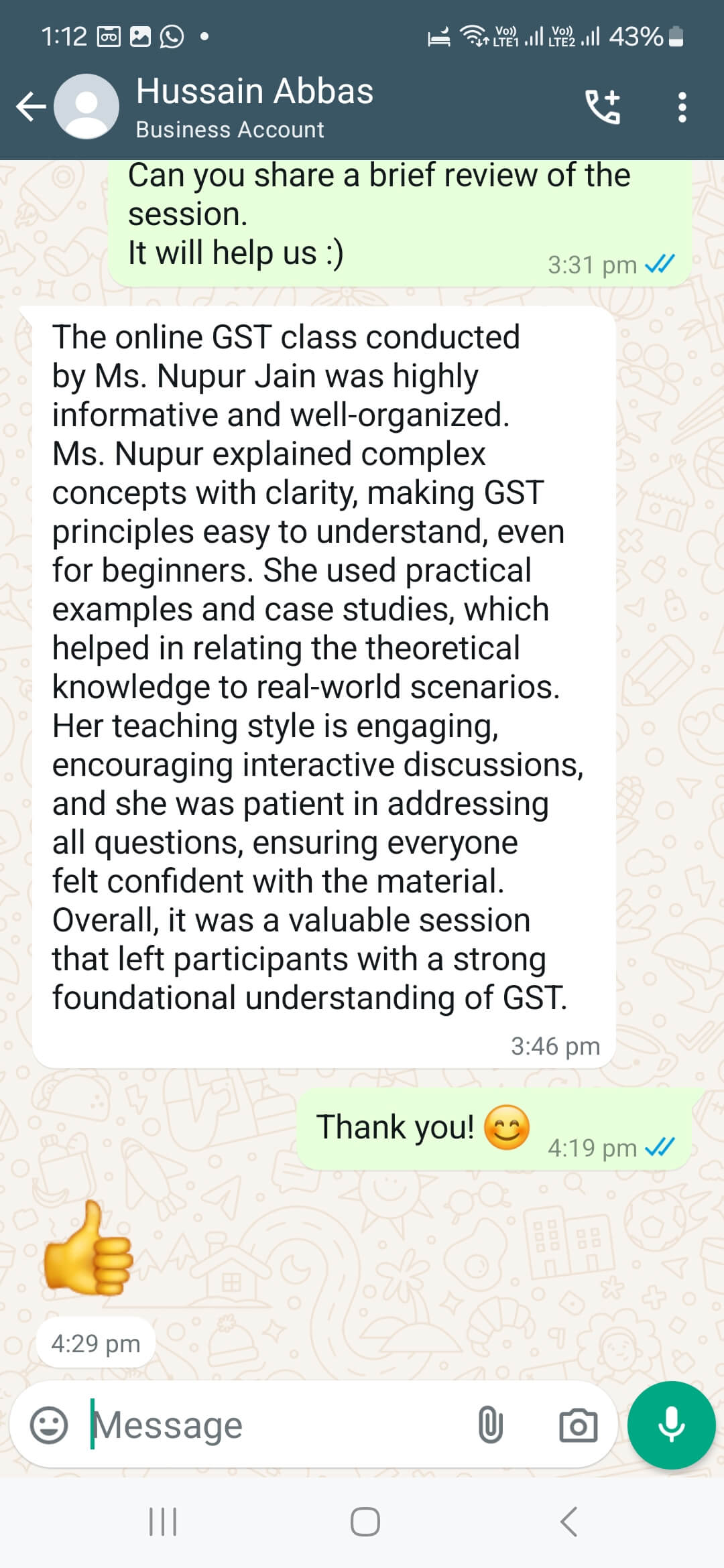

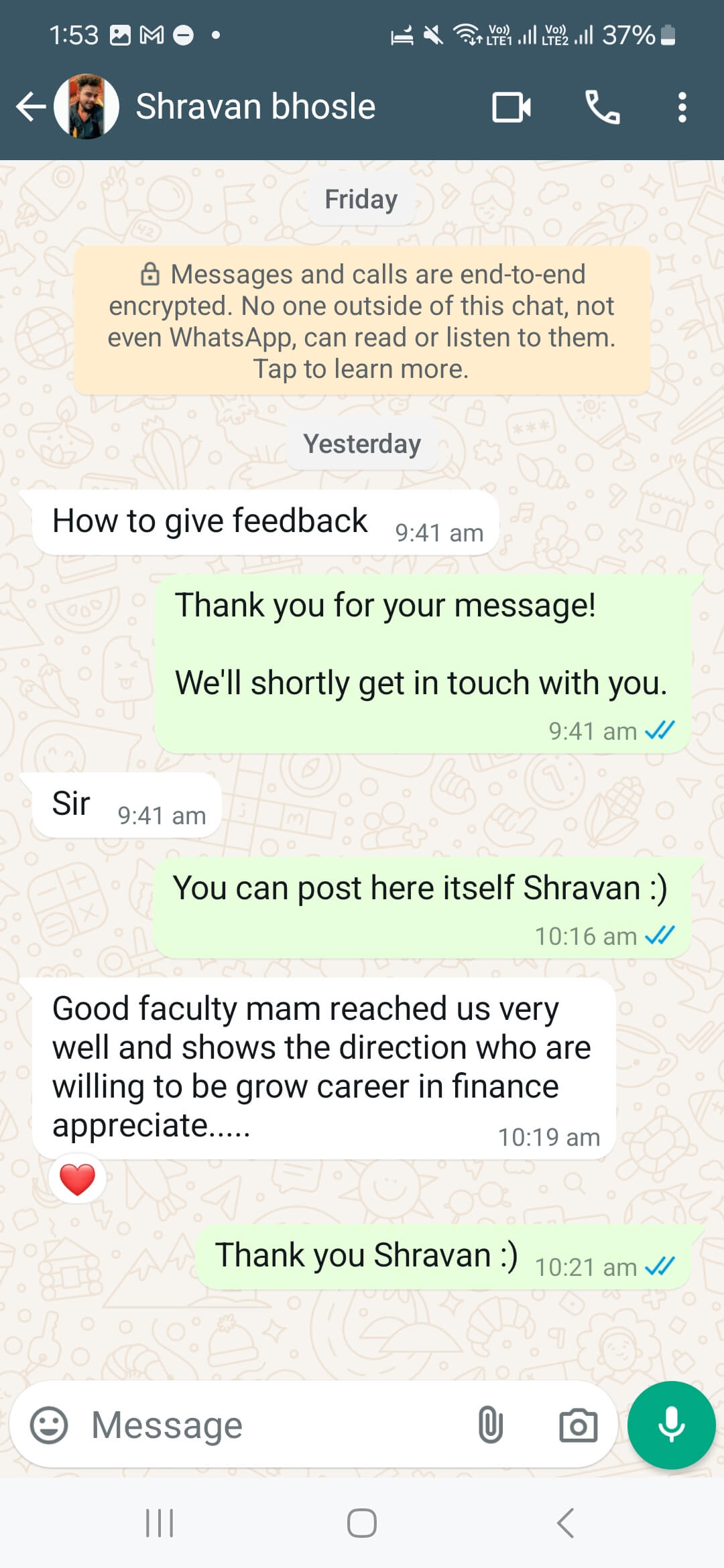

Don't Just Take My Word For It,

Here's Some Proof For You To See...

+ Many More

Frequently Asked Questions

How will I get the link to attend the Workshop?

After you sign up for the workshop, you'll be directed to join our WhatsApp group. Make sure to join the group so you can get all the updates and the workshop link.

Is there a spefic device requirement?

No, you can join & learn from any device i.e. your mobile phone / laptop / macbook / any other device.

How will I get the bonus items?

After you sign up for the workshop, you'll also receive the drive link to download all the above-mentioned bonuses.

Are there any pre-requisites to attend this workshop?

No, there are no pre-requisites. NO prior knowledge or degree is required to attend this workshop.

What should I be prepared with before the workshop starts?

Make sure you come 10 mins before the scheduled time and have a simple notebook and pen to write the important points you find during the workshop.

Will it be recorded?

No, it won't be recorded.

I still have query other than above-mentioned

Please email us at support@taxvidyaarthi.in & our support team will get back to you within 24 hours.